Employee 401k match calculator

But any match is generally considered good since it represents a risk-free return on investment. Some rules of thumb for reading the SIMPLE IRA contribution calculator results include.

What Is A 401 K Match Onplane Financial Advisors

Contribution of salary your employers match of your contribution and maximum match of salary.

. Annual rate of return. Dec 03 2014 KPMG 401K Plan. While the word match can imply they contribute the exact same amount that you do thats often not the case.

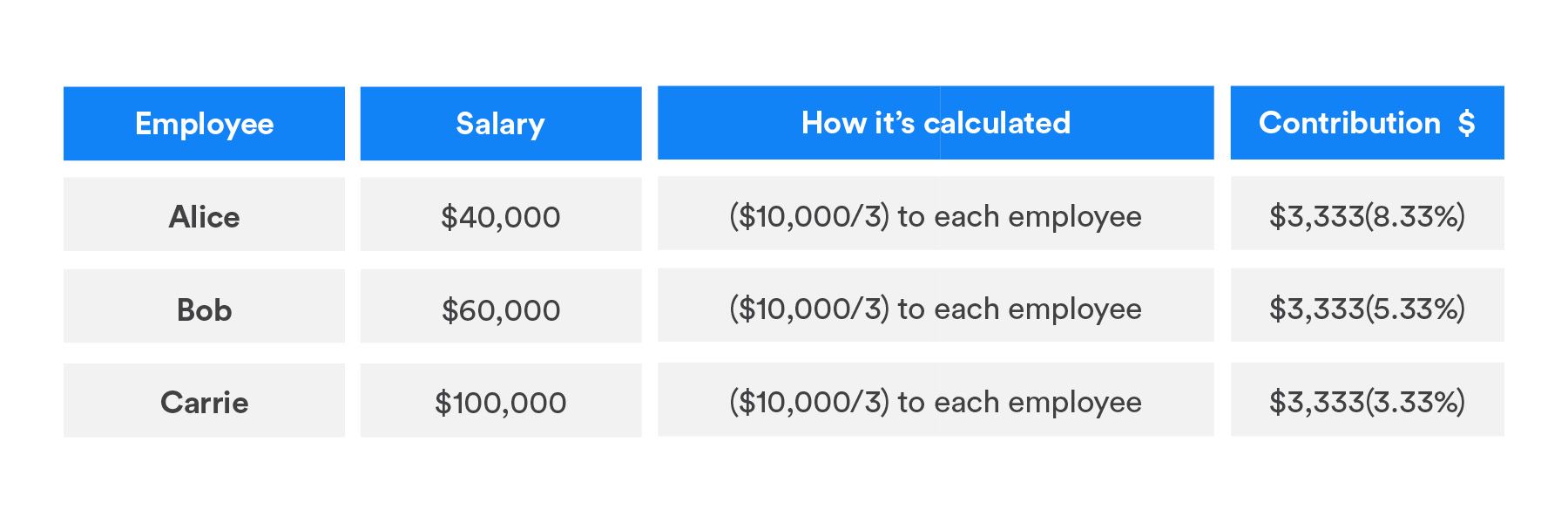

We automatically distribute your savings optimally among different retirement accounts. For example suppose you had gross pay of 50000 a year and got paid every two weeks. As part of a 401k plan employers can choose to match employee contributions usually up to a certain percentage of the employees paycheck.

There are a few different ways employers can match an employees 401k contribution. We stop the analysis there regardless of your spouses age. The Home Depot 401K Plan reported anonymously by The Home Depot employees.

What does 401k match look like at BCG. What 401K Plan benefit do The Home Depot employees get. With this key job benefit your employer adds to the money you save boosting your 401k account over the long term.

Step 5 Determine whether the contributions are made at the start or the end of the period. What does 6 401k match means. Which benefits does Blue Origin provide.

I updated the labels and comments for the Employer Match section so it is more clear how to specify the limit on the employer match. 401k Employer Match Calculator Many employees are not taking full advantage of their employers matching contributions. 624 employees reported this benefit.

Nothing to sneeze at. An MMM-Recommended Bonus as of August 2021. We assume you will live to 95.

A 401k is an employer-sponsored retirement plan that lets you defer taxes until youre retired. Also employee purchase stock options at half the price. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and student.

401k Calculator - Estimate your 401k savings at retirement. The IRS allows plans to reach up to 61000 in combined employeremployee contributions. Not a one to one match in contribution between employee and employer.

Excellent 401k program with company match. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. A 401k calculator can help you see how these matching contributions or larger yearly contributions can impact your retirement savings.

Provides up to 4 weeks per year in addition to 14 holidays. One of the best benefits I had was from Costco they had 401k healthcare I only ever paid 20 for copays dental and vision and they are pretty generous in terms of raise every 1000 hours and free acupuncture 20x a year. Updated October 26 2020.

Medical dental vision basic and supplemental life insurance short and long-term disability and 401k with up to 5 company match. Sometimes theyll choose to contribute only a certain percentage of how much you contribute to your 401k. An S-Corp 401k is beneficial in helping business owners contribute income towards retirement in addition to offering valuable tax deductions.

This means that the employer is matching up to a total of 6 of an employees overall compensation to his or her 401k account on top of. We assume that the contribution limits for your retirement accounts increase with inflation. If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit or 27000 year 2022 limit for those 50 years or older in the first few months of the year then you have probably.

In 2022 individuals can contribute up to 20500 under 50 or 27000 over 50 to their 401k retirement plans. A 401k plan gives employees a tax break on money they contribute. Company match is only HALF a percent.

Former All Around Employee in South San Francisco CA California. Typical employer matches are a 50 of employee contributions up to 6 of the gross salary OR b 100 of. If you contributed 5 percent of your salary to a 401k plan your contribution would be 96 a pay period but your pay would fall by 82 assuming you were in the 15 percent tax bracket according to a calculator from Fidelity Investments.

No perks very basic 401k match vesting over 3 years. Commission-free trades are everywhere. A Solo 401k plan is a 401k plan for self-employed business owners with no other full-time employees other than the owner and co-owner or spouse if applicable.

Thats quite an accumulation of savings over 37 years. The best 401k match would be a 100 match up to the allowable limits. Your employer match is 100 up to a maximum of 4.

These boxes on the W-2 provide all the identifying information related to you and your employer. 401K Plan 349 comments. A 401k match is money your employer contributes to your 401k.

Step 6 Determine whether an employer is contributing to match the individuals contributionThat figure plus the value in step 1 will be the total contribution in the 401k Contribution account. A 401k is a retirement savings and investing plan that employers offer. A Safe Harbor 401k allows employers to choose a matching contribution amount ranging from 3-6 of an employees contribution or salary.

In addition many employers will match a portion of your contributions so participation in your employers 401k is like giving yourself a raise and a tax break at the same time. Value is so much more than a price tag. Annual SIMPLE IRA Contributions.

The IRS contribution limit increases along with. SIMPLE IRA contributions should be at least 3 percent of annual compensation or 5000If theyre more than 20000 or 8 percent to 10 percent of your employee income it. 401k match is standard Employee stock purchasing is amazing other than that everything else is pretty standard for the most part.

Other Benefits of a 401k. 401k savings to date. Step 7 Use the formula discussed above to calculate the maturity amount of the 401k.

Employer Match Explained. 50 Current. Contributions are automatically withdrawn from.

So if you contribute 10000 over the course of the year your employer will only match the first 6000. Available to US-based employees Change location. Your current before-tax 401k plan contribution is 5 per year.

Stillthats 6000 extra dollars into your account. Showing 110 of 993 comments. A 401k is an employer-sponsored retirement plan.

Youll see your social security number Box A name Box E and address Box F appear here while your employers employer identification number EIN Box B name and address Box C and control number Box D if any appear here as well. How to Read Your SIMPLE IRA Calculator Results. Applying these figures to this calculator returns a before-tax total value of your 401k retirement account of 795517 in year 37 before you retire.

Smarter investors are here.

Employee Compensation Plan Template Luxury Employee Total Rewards Statement Total Pensation Excel Templates Tuition Reimbursement How To Plan

How Safe Harbor 401 K Plans Work Smartasset

401k Employee Contribution Calculator Soothsawyer

401k Contribution Limits And Rules 401k Investing Money How To Plan

401k Employee Contribution Calculator Soothsawyer

Download 401k Calculator Excel Template Exceldatapro

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

401 K Profit Sharing Plans How They Work For Everyone

Excel 401 K Value Estimation Youtube

401k Contribution Calculator Step By Step Guide With Examples

Free 401k Calculator For Excel Calculate Your 401k Savings

Traxpayroll Solutions Traxpayroll Solutions Payroll Software Filing Taxes

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

Customizable 401k Calculator And Retirement Analysis Template

Doing The Math On Your 401 K Match Sep 29 2000

Retirement Services 401 K Calculator